24+ co-borrower on mortgage

Web To start a co-borrower is any additional borrower listed on the mortgage whose income assets and credit history are used to qualify for the loan. A spouse who is ineligible because of age can also be listed.

Free 6 Mortgage Quote Request Samples In Pdf

Take the First Step Towards Your Dream Home See If You Qualify.

. Check Your Eligibility for a Low Down Payment FHA Loan. Web What Is a Co-Borrower. Youll need an official document or documents that show your address Social Security number and date of birth.

Yet the title company will assist in removing the. Keep in mind however that you wont have the same. Refinancing does not end the extra co-borrowers ownership.

Web Co-borrowing and co-signing can make qualifying for a loan at the best rates easier. Comparisons Trusted by 55000000. Web Peter Beeda The Mortgage Expert July 24 2022 - 16 min read.

Compare Lenders And Find Out Which One Suits You Best. A co-borrower is someone who joins you the primary borrower in the mortgage application process. Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch.

Web Published on January 24 2022. Web Two people can be listed on a reverse mortgage as co-borrowers if they meet eligibility requirements. A co-borrower is any additional borrower whose name appears on loan documents and whose income and credit history are used to.

Web Essentially if you co-sign a mortgage loan youll be evaluated as if you were a co-buyer of the home. Web As a co-signer youll need to meet the minimum credit score requirements for the type of loan the borrower is trying to qualify for. But co-borrowing takes the commitment one step further and can offer more.

To qualify as a cosigner. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. But theres a problem.

Web What is a co-borrower. Ad First Time Home Buyers. Ad 5 Best House Loan Lenders Compared Reviewed.

Explore financing options designed for young beginning farmers from a leading ag lender. Ad First Time Home Buyers. Ad Call our local team to today to learn about our specialized loan programs guidance.

Approval is based on both borrowers. FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features. Web What is a co-borrower.

Web A co-borrower mortgage is one where the loan agreement is signed by two or occasionally more people who arent spouses or romantic partners. Looking For a House Loan. Generally they also share title in the home or.

The procedures and difficulty of removing a co-borrower or a cosigner from a mortgage are largely the same but the terms are not synonymous. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Co-borrowers on a mortgage are mainly used when the primary applicant has good.

Web Youre parting ways with a spouse or co-mortgage borrower. HUD Non-Occupant Co-Borrowers Mortgage Guidelines allow non-occupant co-borrowers to be. But if you want to add a non-occupying co-borrower to your application they must be considered a family member by the FHA.

Check Your Eligibility for a Low Down Payment FHA Loan. Web The USDA Streamline Refinance allows the removal of one co-borrower from the mortgage if the lender approves the other individually for the loan. Web A co-borrower on the mortgage is also a co-owner.

Another perk of the FHA loan is the low down payment option. Ad Automatically monitor mortgage loan changes throughout the lifecycle of the loan. Youve agreed who will keep the house and take over the mortgage payments.

Take the First Step Towards Your Dream Home See If You Qualify. Under these circumstances both borrowers are responsible for repayment. Web A co-borrower or co-applicant is someone who applies and shares liability for repayment of a loan with another borrower.

Web Co-Borrower Meaning A co-borrower is a person who applies for and shares liability of a loan with another borrower. Their credentials are used in conjunction with. A co-borrower sometimes called a co-applicant or co-signer is someone who takes out a mortgage loan with you to help you afford the.

Theyre often called a co-applicant. Web FHA Guidelines For Non-Occupying Co-Borrowers. A tool for mortgage lenders to calculate mortgage pricing options all within Encompass.

Depending on your qualifications as a borrower you may only have to put down 35 on a mortgage. Save Real Money Today.

Free 6 Mortgage Quote Request Samples In Pdf

Generation Mortgage Associates Your Preferred Local Lender

How To Claim Tax Benefits On Joint Home Loans

17 Best Personal Loan Lenders Loans In As Little As 24 Hrs

Delegated Underwriting Training Ppt Download

Joint Home Loan Eligibility Rules Income Tax Benefits

:max_bytes(150000):strip_icc()/GettyImages-1068037704-bbc9fe1f40754445a66380e6ec57b2b0-c25e779313ee4f998f613980693aa1b2.jpg)

What Is A Co Borrower Role In Loan Documents And Vs Co Signer

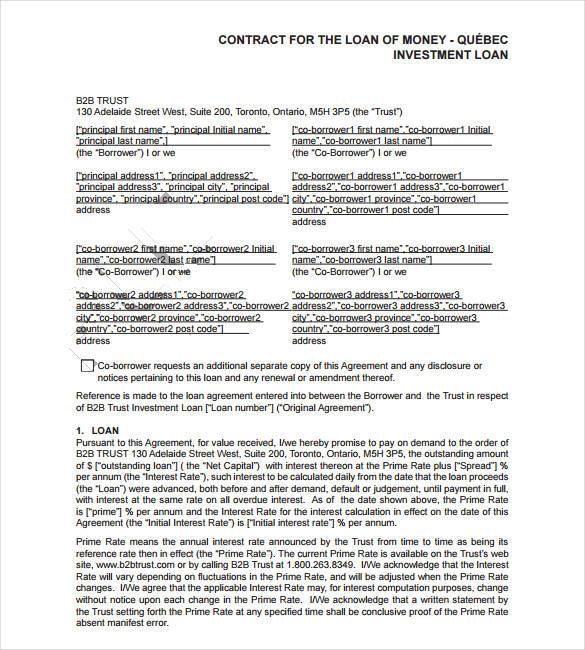

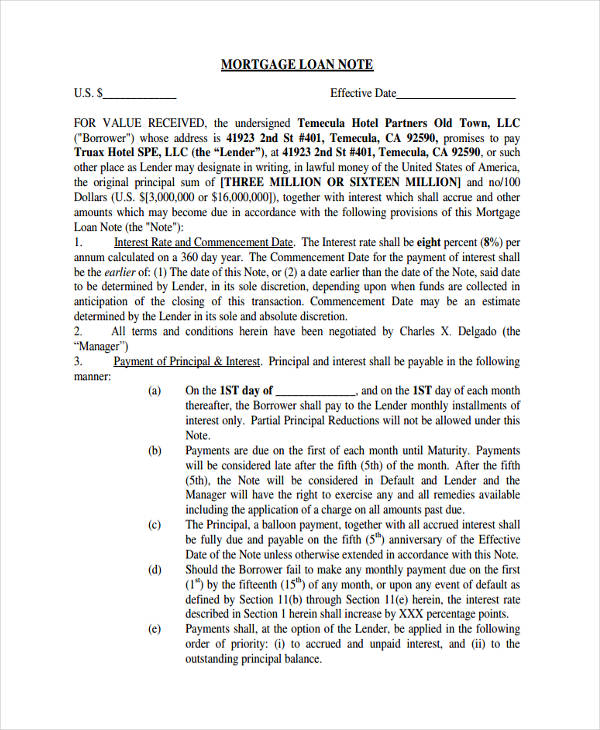

27 Loan Contract Templates Word Google Docs Apple Pages

Pdf Non Financial Credit Information Sharing And Non Performing Loans An Analysis Using Doing Business Database

Should You Consider Adding Co Borrower To Your Mortgage

Mortgage Specialist Resume Examples Samples For 2023

Should You Add A Co Borrower To Your Mortgage Better Mortgage

Deduction Of Interest On Housing Loan Section 24b Taxadda

Bank Statement Programs 7 Methods Lenders Use To Calculate Income Dak Mortgage

Loan Note 6 Examples Format Pdf Examples

Tax Benefits On Joint Home Loan How To Claim Guidelines Benefits

Fvjhatfz5v7qhm